capital gains tax canada changes

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Today only 50 per cent of capital gains on everything from property to stocks and mutual funds are taxed.

Your earnings from the property and the cost of maintaining the property will not change the ACB.

. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. In Canada 50 of the value of any capital gains is taxable. September 1 2021.

In case your taxable income is less than 155625 you. Was introduced in 1965. A report this summer from the Parliamentary Budget Officer estimated a wealth tax of 1 on.

It was then increased to 6667 per cent in 1988 and then to a. According to Jamie Golombek managing. In our example you would have to include 1325 2650 x 50 in your income.

Here in Canada British Columbia already has a wealth tax of sorts on real estate valued over 3 million. The news release that accompanied the. For the illustration above we have ignored the calculation of recapture of.

Taxes on Capital Gains. To fix these problems the inclusion rate for capital gains should rise to 80 per cent from the current 50 per cent. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Only half of it is taxable so you will add 17500 to your taxable income for the year. Is more mixed where capital gains and changes to the highest marginal tax rate have been proposed in a series of changes including the Tax Reform Act of 1986.

In some provinces the current capital gains rate means tax of more than 25 per cent on investments for high income investors. Possible changes coming to tax on capital gains in canada. Accordingly the actual income that you would be taxed on at your marginal tax.

This week the NDPs Jagmeet Singh promised to crack down on big money house flippers. This has canada speculating again if a hike to the capital. Canadas current capital gains tax rate is 50 of capital profits as set by the Canada Revenue Agency.

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. For example if you bought a stock for 10 and sold it for 50 but paid broker fees of 5 you would have a capital gain of 35. The experience in the US.

For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be noted that capital gains are subject to the same top marginal rate of 5353 as income but given that only 50 of a capital gain is taxable it is common shorthand to. The CRA increased the basic personal amount by 590 to 14398 for 2022. The amount of tax youll pay depends on how much youre earning from other sources.

Canadian real estate and capital gains taxes are once again in the spotlight. For more information see What is the capital gains deduction limit. A comprehensive capital gains tax in the UK.

Since its more than your ACB you have a capital gain. The sale price minus your ACB is the capital gain that youll need to pay tax on. The recent passage of Bill C-208 exacerbates these issues.

The effective tax rate is therefore half of your marginal tax rate. In canada 50 of the value of any capital gains are taxable. On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously announced in the 2021 Federal Budget.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Australia introduced a similar tax later in 1985. The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system.

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have altered the tax treatment of family transfers of shares in a qualified small business corporation and shares of the capital stock of a family farm or fishing corporation. This means that the Canadian government applies tax to the profits gained by selling an asset for more than you paid. Your sale price 3950- your ACB 13002650.

This strategy largely involves hitting them with a 75 percent capital gains rate. Owners feel this will unfairly target them. The rates do not stop there.

Additionally a section 1250 gain the portion of a. In other words for every 100 of capital gains generated on a sale or a disposition there is an additional 1338 of tax owed. Feb 7 2022.

They tax 50 of your profits. For tax purposes the gain would only be half of 35. In 1966 the commissions report recommended among other things that a tax be imposed on capital gains.

The maximum pensionable earning is 61600 an increase of 2900 from the 58700 in 2020. Weve highlighted the key updates in our summary below. The capital gains tax rate in Ontario for the highest income bracket is 2676.

One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market. If you sold the property for 560000 you incurred a 35000 profit Capital Gains 560000 Proceeds 525000 ACB. The Proposals include amendments to both the Income Tax Act ITA and the Excise Tax Act ETA.

For instance if you purchased a stock for 5000 and sold it at 10000 you have a capital. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit. NDPs proto-platform calls for levying.

As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. Generally capital gains are taxed on half of the gain.

Self Employed Mortgage Fraud Amend Taxes After Purchasing A Home Business Loans Small Business Loans Filing Taxes

Canada Tax Deductions Tax Credits To Take Advantage Of Business Tax Deductions Tax Deductions Tax Credits

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

Pin On Valmiki Immigration Services

Nuvasive Reports Second Quarter 2016 Financial Results Ortho Spine News Security Companies Risk Analysis Security Tips

Tax Loss Harvesting Tax Brackets Tax Income Tax

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax What Is It When Do You Pay It

Owning Market Leaders Such As Canadian National Railway Company Tsx Cnr Nyse Cni Can Help Canadians Put Tax Free Savings Dividend Stocks Best Stocks To Buy

Karat Gold Cooperation Pte Ltd Karatbars Karatbars International Gold

Taxation Of Investment Income Within A Corporation Manulife Investment Management

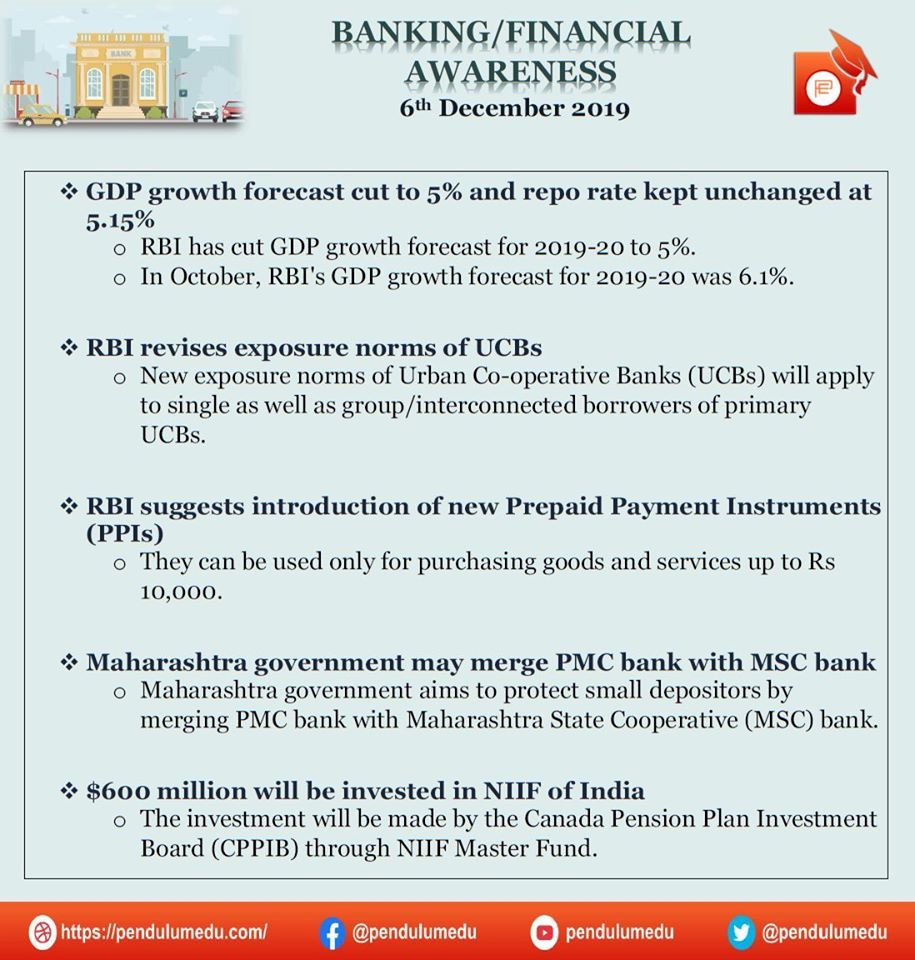

Daily Banking Awareness 06 December 2019 Awareness Banking Financial